How To Calculate Depreciation On Commercial Real Estate

The amount recaptured is taxed at a 25 rate. Thats the difference between paying taxes on 300000 versus paying taxes on 178400.

Understanding Commercial Real Estate Depreciation Than Merrill

Rounded accumulated depreciation totals 128210 after 10 years 500000 divided by 39 12821 x 10 years setting the propertys depreciated value at 371790 500000 minus 128210 on the sale date.

How to calculate depreciation on commercial real estate. Businesses can use the straight line depreciation method. If you can sell the property for 280000 you will recognize a gain of 184540 280000 minus 95460. A good commercial real estate depreciation calculator will look something like this.

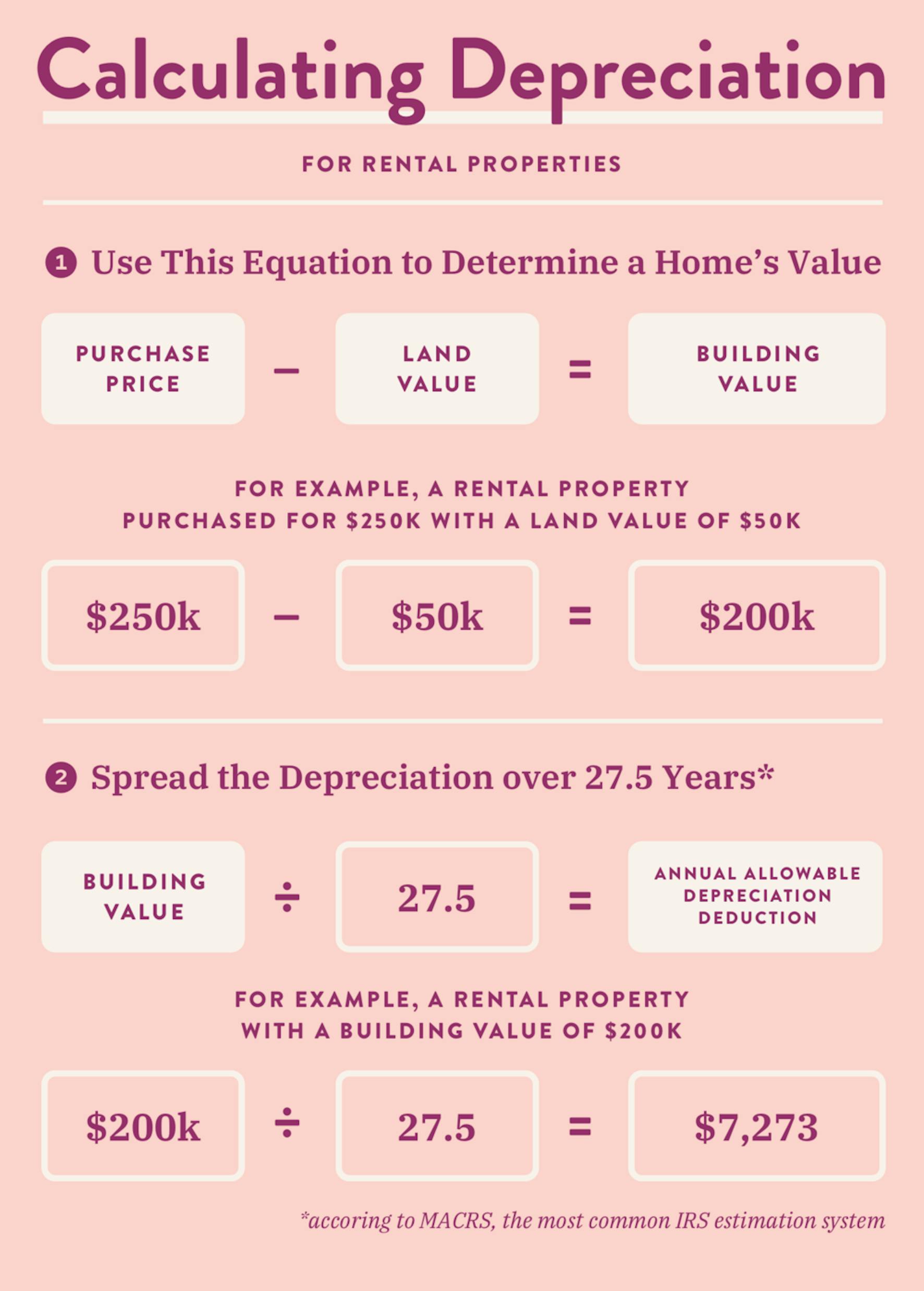

Step 3 Apply the depreciation to your taxes annually for at least 39 years until the property has been fully depreciated. Thats your annual depreciation deduction and you didnt spend any extra dimes on costs to get it. If it is a residential real estate you will divide the value of the real estate by 275 in order to get the amount of depreciation for a single yearOnce this is calculated multiply the amount by the number of months spent on the property.

Therefore to determine the depreciation value of your property you would divide your cost basis by 275 and deduct the remainder as your annual depreciation. Depreciation Recapture Commercial Real Estate. 4 days ago.

Assuming a 396 tax rate John saved almost 50000 in real dollars on his taxes in 2017. Per the IRS tax code residential real estate has a useful life of 275 years. How to Depreciate a Real Estate Value.

The formula for depreciating commercial real estate looks like this. That calculation is covered later under the Depreciation Recapture section. Of course this does not end the whole short-term capital.

You should have written off about 54540 in depreciation deductions over those ten years. 300000 x 396. Then we divide 11900 by the current property value of.

To capitalize on an asset purchase the cost of the new asset is posted to an asset account and the account depreciated over the useful life of the asset. The key takeaways. This rate is different for residential and commercial properties.

Divide the total value by 39 to get your annual depreciation on a straight line basis. We calculate the NOI of 11900 by subtracting all the expenses from the 18000 rental income. For qualified real property see Notice 2013-59 for determining the portion of the gain that is attributable to section 1245 property upon the sale or other disposition of qualified real property.

And bonus depreciation made it all possible. Cost of your property minus the value of the landBasis Basis divided by 139ththe amount you can depreciate annually. Heres the formula used to determine basis and depreciation on commercial assets.

The IRS depreciation period is 39 years on commercial rental property. Called a Depreciation Recapture tax it applies to commercial real estate property. Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense 1250000 cost of property 250000 land value 1 million basis 1 million basis 39 years 25641 annual allowable depreciation.

The depreciation period is 275 years for residential properties and 39 years for properties of a commercial nature. To get the cap rate of Property Bs. A Simple Example of Straight-Line Depreciation If a certain property that cost 180000 can be depreciated using a tax life of 275 years you would divide 180000 by 275 to yield a straight-line equal amount of 6545 in depreciation each year.

Commercial Real Estate Depreciation. 544 under Section 1245 Property. Instead use the rules for recapturing depreciation explained in chapter 3 of Pub.

Cost Of The Home The Value Of The Land The Basis Basis The Amount Of Years The Home May Be Depreciated Yearly Allowable Depreciation. Cost Segregation Depreciation of Commercial Property. Depreciation lets you deduct the cost of acquiring an asset in this case real estate over a period of time.

Then we divide 8075 by the current property value of 90000 and the result is 897. To sum up the key points on commercial property depreciation. Depreciation matches the expense of using the asset during its useful life and the revenue it generated.

To determine the amount of depreciation that an investor can take annually the IRS determines the rate at which investors can depreciate improvements land is not depreciable. Your adjusted cost basis in this property after the ten years is 95460 the original cost basis of 150000 minus 54540.

Understanding Net Operating Income In Commercial Real Estate

Free Macrs Depreciation Calculator For Excel

Commercial Real Estate Depreciation How Does It Work Commercialcafe

How To Calculate Depreciation Expense For Business

How To Deduct Rental Property Depreciation Wealthfit

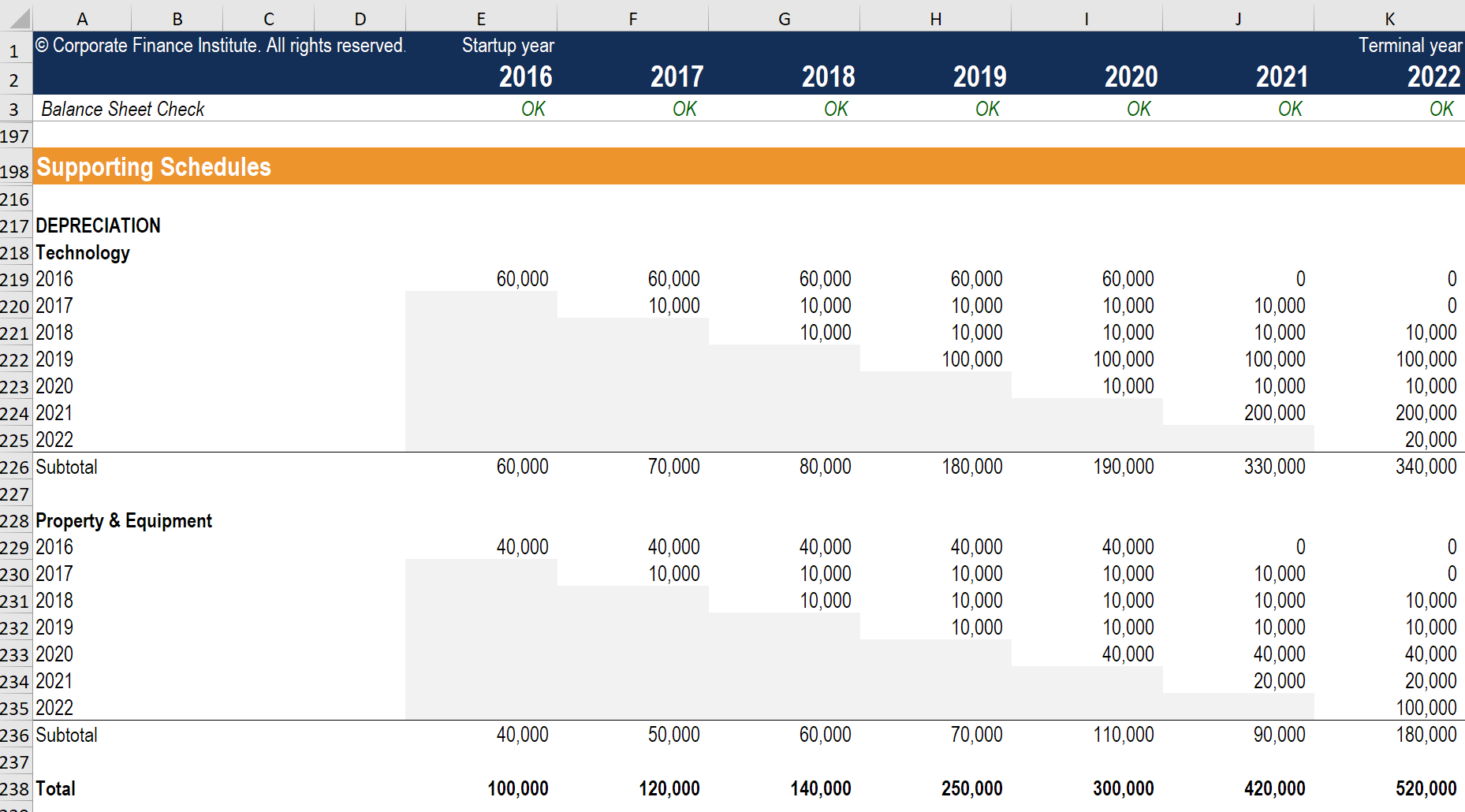

Depreciation Schedule Guide Example Of How To Create A Schedule

Straight Line Depreciation Retipster

Commercial Real Estate Depreciation How Does It Work Commercialcafe

Straight Line Depreciation Formula Guide To Calculate Depreciation

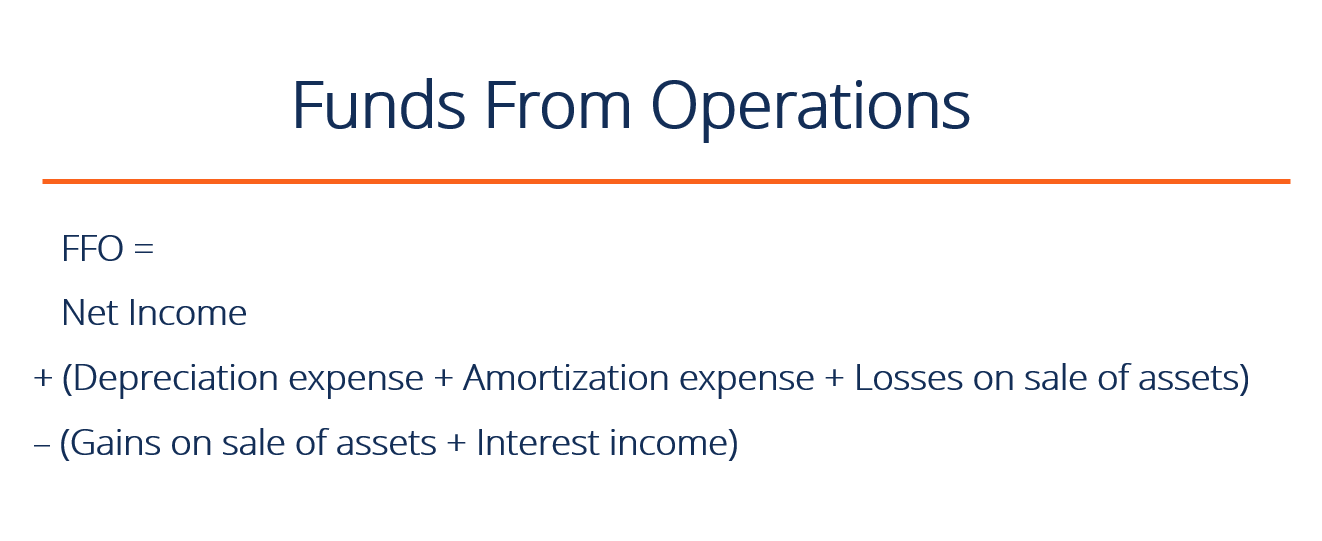

Ffo Funds From Operations Real Estate Cash Flow Metric

Straight Line Depreciation Retipster

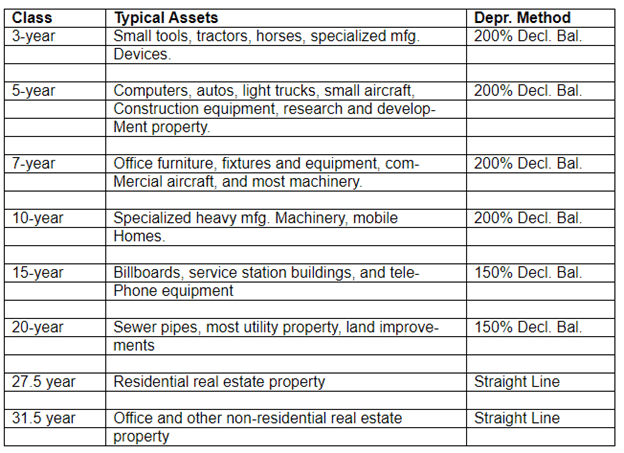

Guide To The Macrs Depreciation Method Chamber Of Commerce

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Depreciation Using Macrs Fast Capital 360

Straight Line Depreciation Formula Guide To Calculate Depreciation

A Guide To Property Depreciation And How Much You Can Save

How To Deduct Rental Property Depreciation Wealthfit

Understanding Commercial Real Estate Depreciation Than Merrill

How To Calculate Depreciation Using Macrs Fast Capital 360