How To Solve Depreciation Without Salvage Value

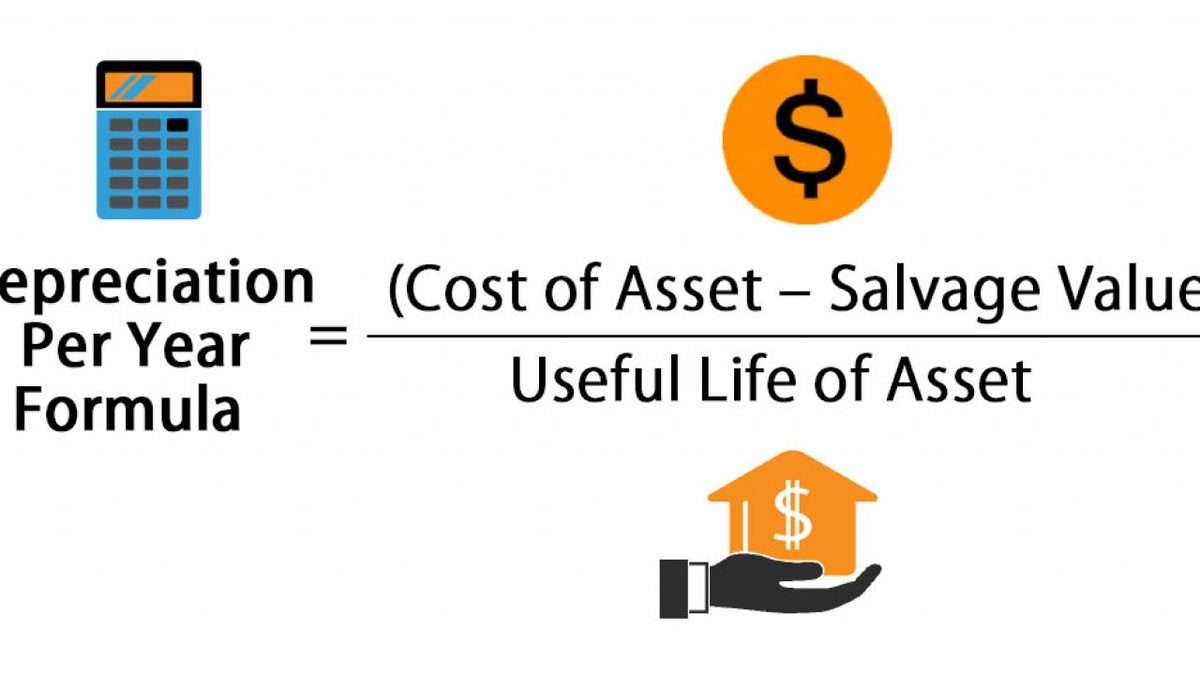

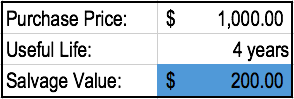

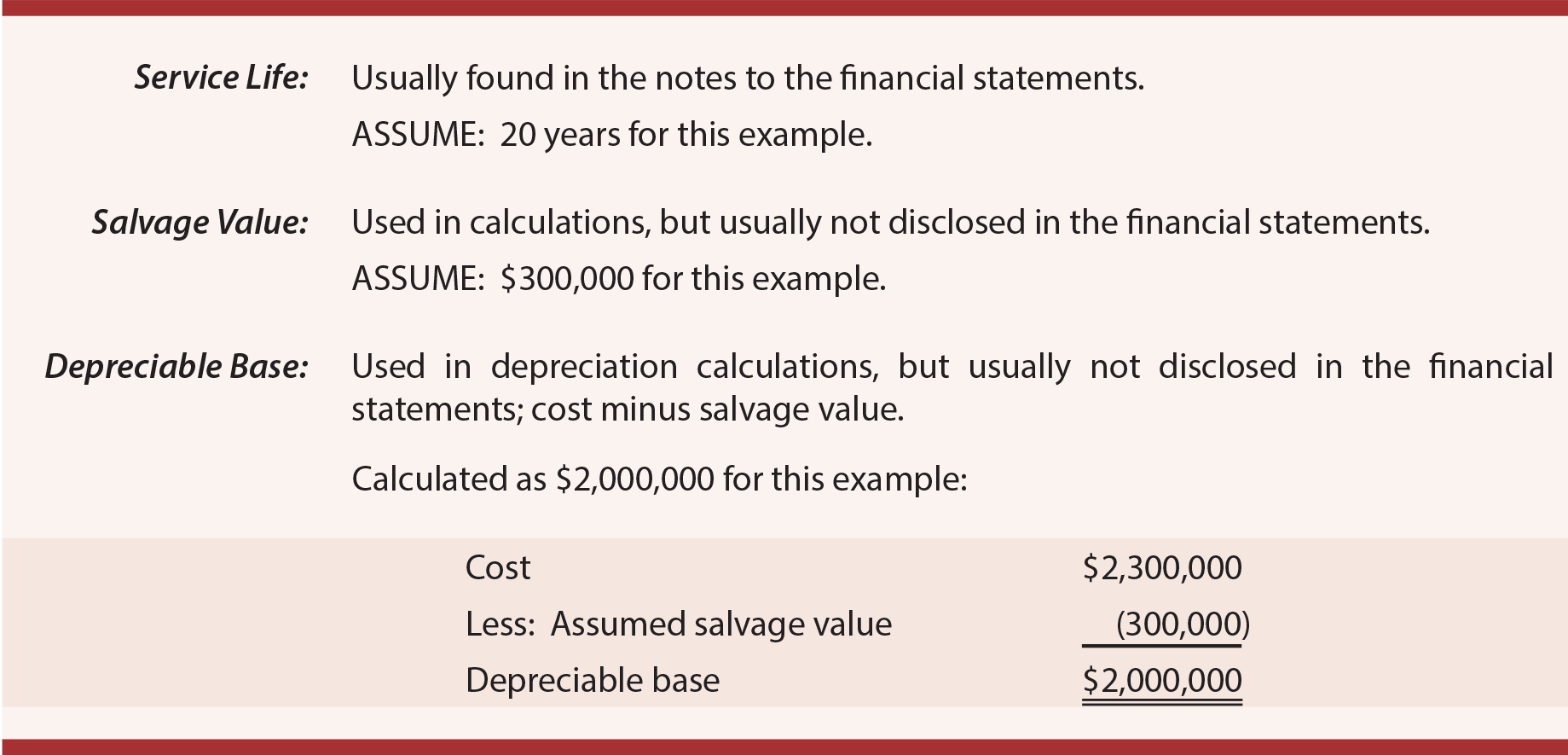

Regardless of the method used the first step to calculating depreciation is subtracting an assets salvage value from its initial cost. The straight-line method of depreciation assumes a constant rate of depreciation.

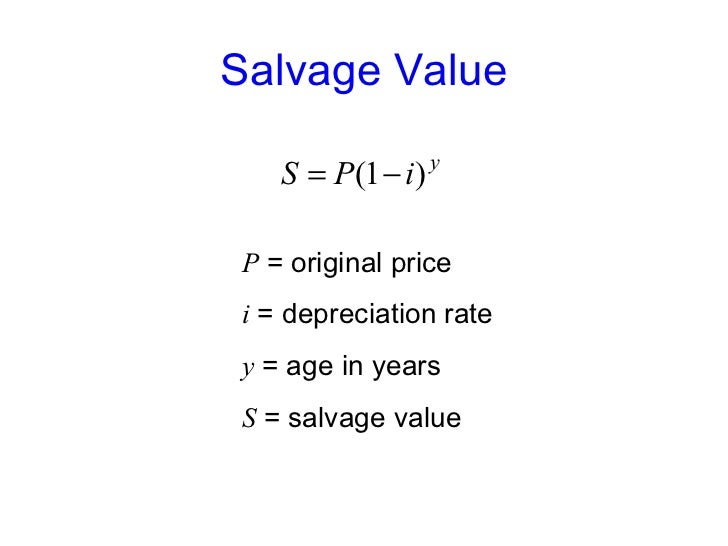

B Book value over a period of time S Salvage value N Total estimated life of an asset t Number of years of the asset.

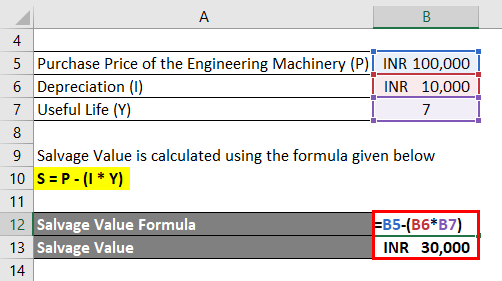

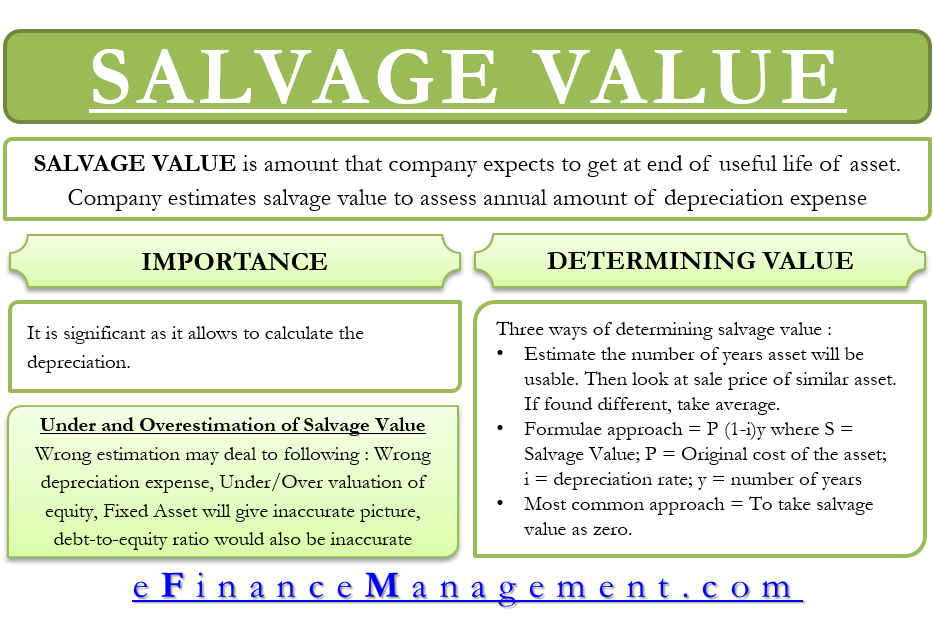

How to solve depreciation without salvage value. Perhaps the most common calculation of an assets salvage value is to assume there will be no salvage value. It calculates how much a specific asset depreciates in one year and then depreciates the asset by that amount every year after that. Also known as scrap or salvage value this is the value of the asset once it reaches the end of its useful life.

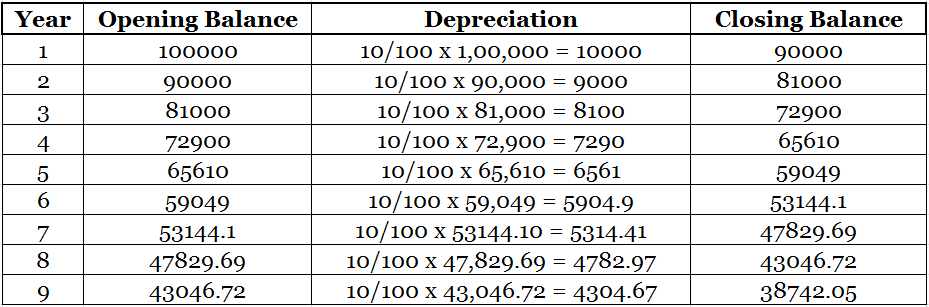

As a result the entire cost of the asset used in the business will be charged to depreciation expense during the years. Depreciation is calculated by taking the useful life of the asset available in tables based on the type of asset though you may need an accountant for this less the salvage value of the asset at the end of its useful life also determined by a table divided by the cost of the asset including all costs for acquiring the asset like transportation set-up and training. To calculate reducing balance depreciation you will need to know.

How To Calculate Monthly Accumulated Depreciation The Motley Fool. To determine an assets book or carrying value subtract total accumulated depreciation from the assets purchase price. Salvage value is also referred to as disposal value residual value or scrap value.

Solved Installs Machinery Costing 683 760 That Has A 10. Calculate depreciation rate ie 1useful life Multiply the beginning period book value by twice the depreciation rate to find the depreciation expense Deduct the depreciation expense from the beginning value to calculate the ending period value Repeat the above steps till the salvage value. Example of Asset Salvage Value.

The expected life is. Find the present amount or worth when the book value is 20 the salvage value is 10 the total estimated life of an asset is 5 and the number of years of the asset is 9. Determine the useful life of the asset.

Lets solve an example. SL Cost Life Example. After three years the book value of the machine in our example will equal 3000 6000 - 3000.

Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Multiply the current value of the asset by the depreciation rate.

To calculate depreciation expense on a fixed asset without a salvage value the cost is divided by the life. The original value of the asset plus any additional costs required to get the asset ready for its intended use. In the first year of use the depreciation will be 400.

Accumulated Depreciation And Depreciation Expense. Salvage value or Scrap Value is the estimated value of an asset after its useful life is over and therefore cannot be used for its original purpose. How to Calculate Salvage Value.

Solved Below Are Three Independent Lease Scenarios Payments Are. To calculate depreciation subtract the assets salvage value from its cost to determine the amount that can be depreciated. Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates loses value over time.

Even some intangible assets such as patents lose all worth once they expire. You can still calculate depreciation without a salvage value. This calculation will give you a different depreciation amount every year.

Divide by 12 to tell you the monthly depreciation for the asset The value of a business asset over its useful life is known as depreciation. A table is purchased for 56765. Divide this amount by the number of years in the assets useful lifespan.

For example if the machinery of a company has a life of 5 years and at the end of 5 years its value is only 5000 then 5000 is the salvage value. This means that for every copy produced youll multiple that number times 0015. Units of production depreciation does use salvage value so your first year calculation would look like this.

How To Use The Excel Ddb Function Exceljet

Salvage Value Formula Calculator Excel Template

Straight Line Depreciation Double Entry Bookkeeping

How To Calculate Scrap Value Of An Asset Accountingcapital

Salvage Value Calculation Youtube

Salvage Value Formula Calculator Excel Template

Straight Line Depreciation Template Download Free Excel Template

Straight Line Depreciation Definition And Formula Bookstime

Straight Line Depreciation Formula Guide To Calculate Depreciation

Salvage Value Formula Calculator Excel Template

Depreciation Formula Examples With Excel Template

Salvage Value Learn How To Calculate An Asset S Salvage Value

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Formula Guide To Calculate Depreciation

Salvage Value Meaning Importance How To Calculate

Single Line Depreciation Method Of Accounting

How To Calculate Book Value 13 Steps With Pictures Wikihow

Depreciation Concepts Principlesofaccounting Com

Salvage Value Formula Calculator Excel Template