How To Calculate Unit Price Of Mutual Fund

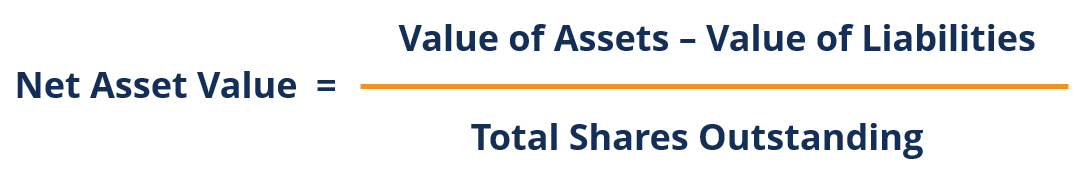

In other words one MF units price will be equal to that funds net value divided by the number of outstanding shares. Many mutual funds use this.

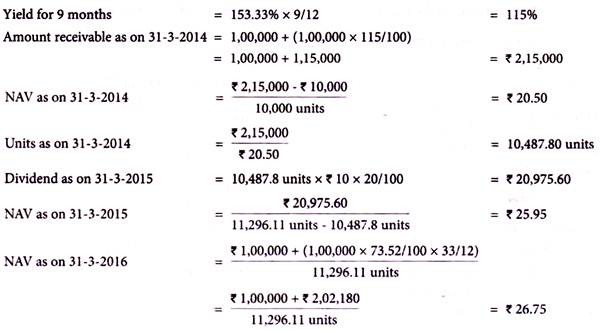

Calculating Nav Of Mutual Fund With Formula Financial Management

As such price of a mutual.

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

How to calculate unit price of mutual fund. For example if an open-end funds per unit is Rs11 with front load of 2. There is no loss. The investment return calculator results show the Invested Total Capital in green Simple Interest Total in red and the Compound Interest Total in Blue.

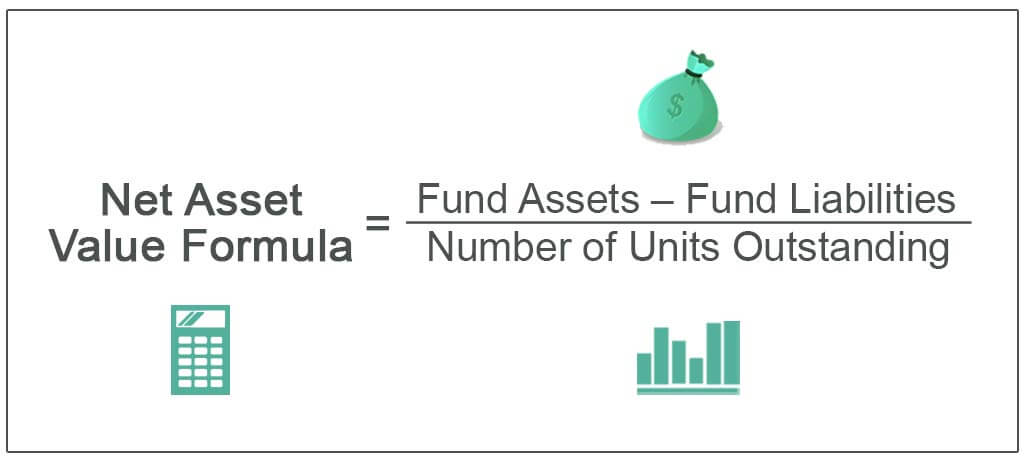

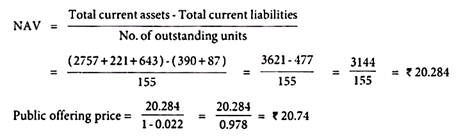

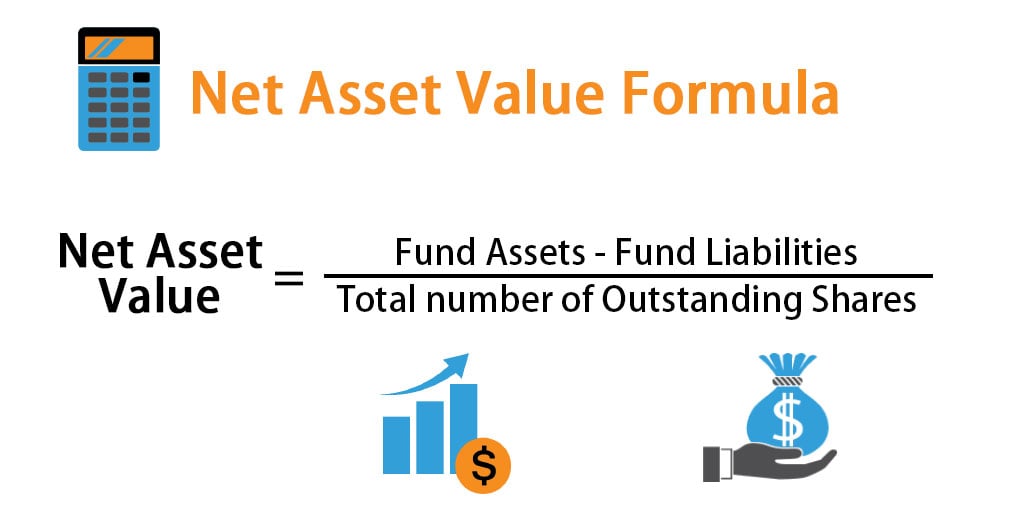

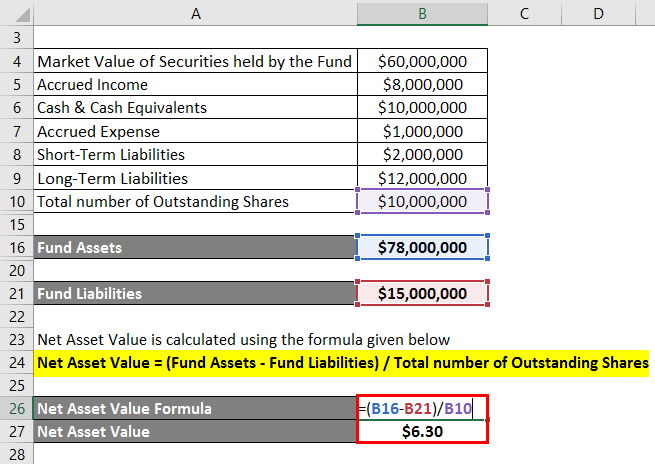

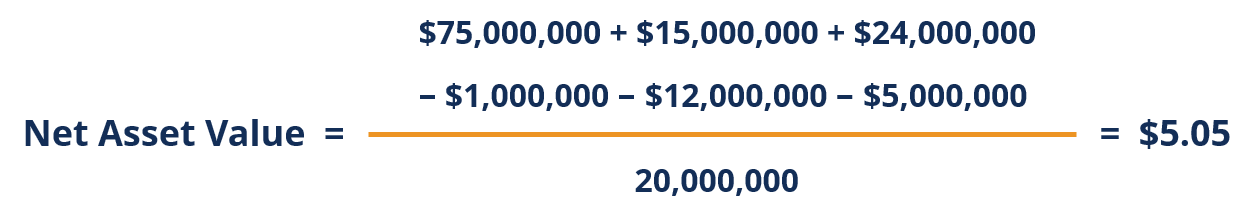

Net Asset Value NAV is the total value of all of a funds assets minus its liabilities divided by the number of outstanding shares for that fund. If the market value of securities of a mutual fund scheme is Rs 300 lakhs and the mutual fund has issued 20 lakh units of Rs. The per-share value of a portfolio is referred to as Net Asset Value NAV sometimes denoted as Net Asset Value per share NAVPS.

For instance if a mutual fund has 100 million in assets and 10 million in liabilities its net assets are 90 million. To standardize the value of assets to every unit this value is then divided by the total number of outstanding units to yield the net asset value. 6261483 x 154425 Current value of investment.

A funds NAV is calculated daily using the price of the securities in the mutual fund at the market close. The NAV of one unit equals the total NAV of the mutual fund divided by the number of shares. Firstly I presume that you are asking for the calculation of value for each mutual fund unit.

Outstanding share represents the number of units of a mutual fund. That value which is recalculated each day the stock market is open is determined by dividing the total assets minus all liabilities by the number of outstanding shares each day. In other words Rs100 would buy units Rs100 Rs211 89 units.

The easiest way to find out the price of a mutual fund is to look at its net asset value. The entry load percentage is added to the NAV at the time of allotment of units. Enter your initial investment future contributions time horizon and projected annual return.

HDFC Hybrid Equity Fund had a NAV of Rs. NAV is the total value of a mutual funds assets less all of its liabilities. By dividing the total value of a fund by the number of outstanding units you are left with the price per unitthe form of measurement in which NAV is usually quoted.

300 Lakhs 20 Lakhs 15. When a mutual fund investor receives distributions that are reinvested the value of the distribution has an impact on the price of the mutual fund and the number of units owned. At the end of the year the unit value was 1889 per share.

Before we learn the formula for calculating NAV we must understand what total asset value and expense ratio are. The amount invested by investors is called assets under management. To know more about NAV you can read this detailed post on Net Asset.

Net Asset Value is the sum total of the market value of the units in a Mutual Fund. Net Asset Values NAVs. 10 each to the investors then the NAV per unit of the fund is Rs15.

You can click on them in the bottom legend to hide or make them visible again. Initial investment amount required Time horizon years required Fund. The NAV per share represents the mutual funds assets less its liabilities and will change due to fluctuations of the market value of your mutual funds investments.

Every scheme has their own plans. The mutual fund calculator shows the power of compounding your returns. To calculate NAV the overall expense ratio is subtracted from the asset value.

NAV helps you to calculate what is the worth of mutual fund in a market. 52914 per unit on 1st June 2018. Mutual fund calculator.

NAV is the cost of one unit of a mutual fund. Every mutual fund has different kinds of schemes. Mutual Fund Calculator Results Explained.

Net Asset Value NAV represents the price of a mutual fund. When you do the math the fund increased in price by 241 or a 145 increase. The price at which an investor can buy a unit is Rs1122.

The cost is derived by dividing the pooled money in the mutual fund by the number of units of the mutual fund. If you are Sharekhan customer or investor then you can calculate it by using MF Calculator on its website. How to calculate NAV of mutual fund.

6261483 x 154425 units in HDFC Hybrid fund x 52914. So she would now hold 1827360 units of HDFC Hybrid Fund due to the switch. The difference is simply two distributions that the fund paid out in July and.

For example if a funds net asset value equals 10 million and the fund has issued 1 million units. The fund might not calculate until hours after you purchased or redeemed shares. To elaborate in connection with Canadian tax law most mutual funds make distributions at least annually.

The net asset value or NAV is the value of each share of the mutual fund. Although this is impressive there is a significant difference between the 229 return and the 145 return by tracking price. Important part of the funds investment performance.

So this is how the switch works. The mutual fund price depends on its net asset value or NAV. Unlike a stock price which you can find hour-to-hour or even second to second finding a price to buy or sell a mutual fund depends on its NAV when its posted daily.

How Net Asset Value NAV Determines a Mutual Funds Share Price. A mutual funds NAV can be derived on a daily weekly or monthly basis.

Calculating Nav Of Mutual Fund With Formula Financial Management

Mutual Fund Nav Check Today S Latest Mf Nav Online Fincash Com

How To Calculate Mutual Fund Returns Quick Easy Methods

How To Calculate The Net Asset Value 11 Steps With Pictures

Net Asset Value Definition Formula And How To Interpret

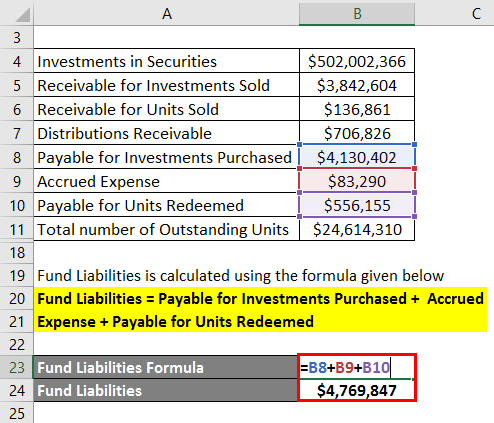

Net Asset Value Formula Calculator Examples With Excel Template

Net Asset Value Formula Calculator Examples With Excel Template

How To Calculate Mutual Fund Returns Quick Easy Methods

Open End Mutual Funds Overview Net Asset Value Pros And Cons

What Is The Net Asset Value Nav Of Mutual Funds Scripbox

Net Asset Value Definition Formula And How To Interpret

How To Calculate The Net Asset Value 11 Steps With Pictures

Net Asset Value Formula Calculator Examples With Excel Template

What Is The Net Asset Value Nav Of Mutual Funds Scripbox

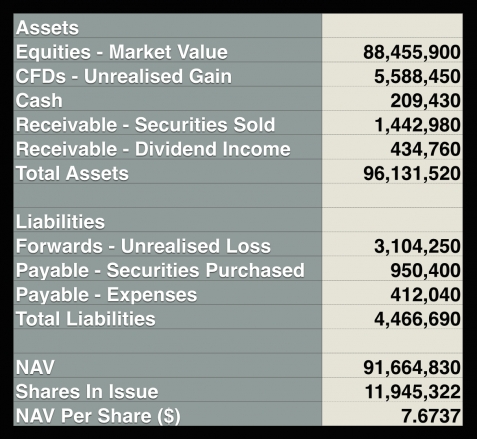

Nav Calculation Explained In 5 Minutes With A Simple Example Quickstep Training

Net Asset Value Definition Formula And How To Interpret

/GettyImages-508546190-42c6db292a914db98906dea90b982c56.jpg)